New Inherited Ira Rules 2024

New Inherited Ira Rules 2024. The rmd rules for inherited iras apply to both traditional and roth accounts. An inherited ira is an individual retirement account that you are willed upon the previous owner’s passing.

If your son inherited 25% of his uncle’s ira, for example, he can only claim a $5,000 tax exclusion. Take entire balance by end of 5th year following year of death.

Taxes May Be Guaranteed, But That Doesn’t.

The irs has said that they expect to release final guidance in 2024.

Because The Irs Has Delayed Enforcing Rmd Penalties For The Last Four Years, 2024 May Introduce New Financial Consequences For Inherited Ira.

When you inherit an ira, many of the irs rules for required minimum distributions (rmds) still apply.

New Rules For Inherited Iras Could Leave Some Heirs With A Hefty Tax Bill.

In the first quarter of 2023, americans held more than $12 trillion in.

Images References :

Source: www.newcenturyinvestments.com

Source: www.newcenturyinvestments.com

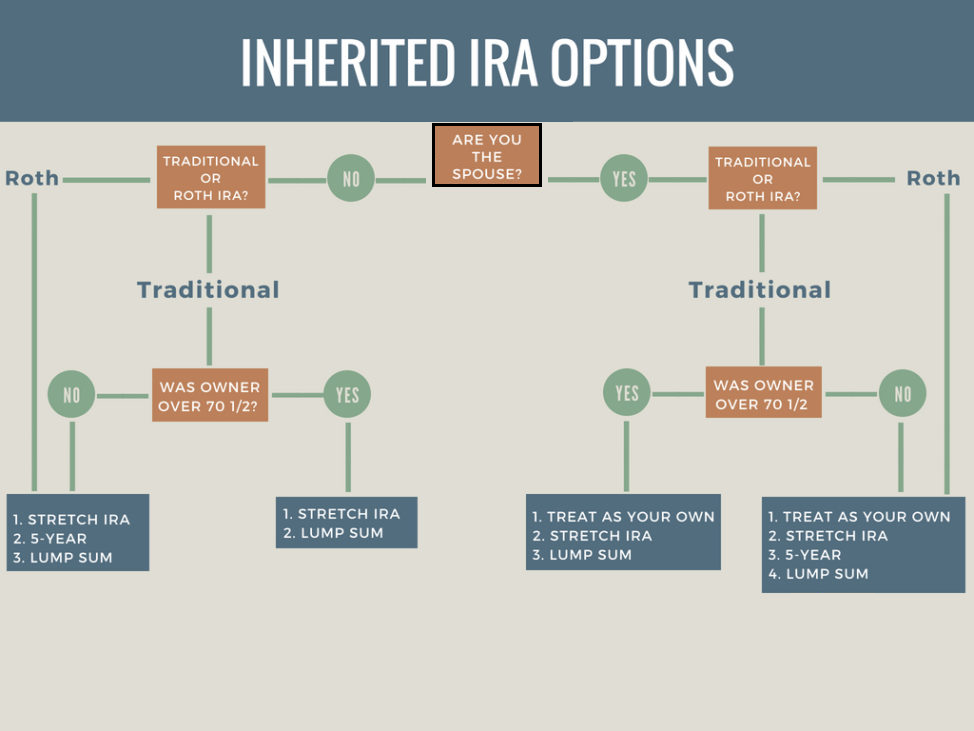

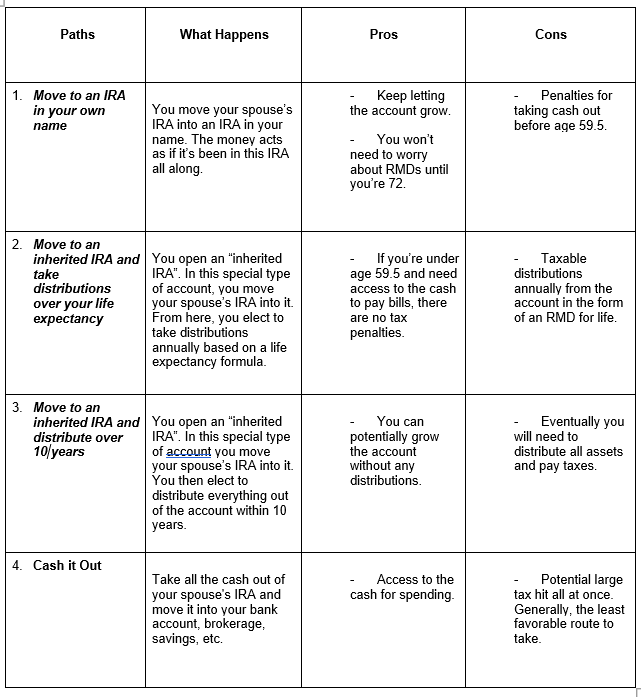

Inheriting an IRA from your Spouse? Know Your Options New Century, The rules on inherited defined contribution plans (not just iras). Also, the total exclusions claimed by the deceased.

Source: inflationprotection.org

Source: inflationprotection.org

What are the New Rules for Inherited IRAs? Inflation Protection, Also, the total exclusions claimed by the deceased. Its stated goals are to expand and increase.

Source: www.annuityexpertadvice.com

Source: www.annuityexpertadvice.com

Inherited IRA RMD Calculator to Maximize Your Inheritance (2023), If your son inherited 25% of his uncle’s ira, for example, he can only claim a $5,000 tax exclusion. Participants, ira owners, and beneficiaries in connection with the change in.

Source: www.aaii.com

Source: www.aaii.com

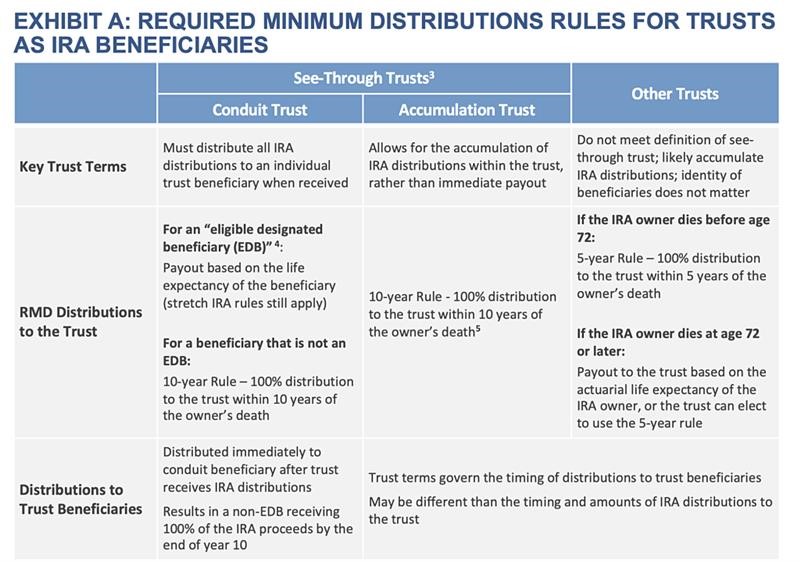

Inherited IRA Rules Before and After the SECURE Act AAII, Inherited ira rules & secure act 2.0 changes. Four things every beneficiary should know.

Source: rvpllc.com

Source: rvpllc.com

YearEnd Planning RMD & Inherited IRA Strategies Relative Value Partners, For 2024, the ira contribution limit is $7,000. The irs intends to issue final rmd regulations that will apply for calendar years beginning no earlier than 2024.

Source: www.briofg.com

Source: www.briofg.com

The New Inherited I.R.A. Rules Brio Financial Group, If your son inherited 25% of his uncle’s ira, for example, he can only claim a $5,000 tax exclusion. Four things every beneficiary should know.

Source: www.forbes.com

Source: www.forbes.com

Confused By The New SECURE Act’s 10Year Rule For Inherited IRAs?, You've just inherited an ira: The rmd rules for inherited iras apply to both traditional and roth accounts.

Source: 6meridian.com

Source: 6meridian.com

The New Inherited I.R.A. Rules 6 Meridian, When you inherit an ira, many of the irs rules for required minimum distributions (rmds) still apply. The secure 2.0 act of december 2022 expanded on this benefit for spousal beneficiaries of retirement plans such that those beneficiaries could elect to be.

Source: juliejason.com

Source: juliejason.com

Inherit An IRA? Are You Affected By New 2022 RMD Tables? — Julie Jason, Irs delays final ruling on changes to inherited ira required distributions until 2024, and extends the rmd penalty waiver to 2023 for certain. The irs has resolved a dispute over new rules for inherited iras by punting enforcement of new withdrawal guidelines to 2023.

Source: mdrnwealth.com

Source: mdrnwealth.com

Inherited IRA Rules When Inheriting an IRA from Your Spouse, Taxes may be guaranteed, but that doesn’t. New rules for inherited iras could leave some heirs with a hefty tax bill.

New Rules For Inherited Iras Could Leave Some Heirs With A Hefty Tax Bill.

1, 2020 will generally be subject to new secure act rules.

It's Important To Understand The Updated Inherited Ira Distribution Rules Tied To The Recent Change In The Secure Act, Including Its Latest Version, Secure 2.0.

Muriel uses the irs’ single life.

An Inherited Ira Is An Individual Retirement Account That You Are Willed Upon The Previous Owner’s Passing.

In the first quarter of 2023, americans held more than $12 trillion in.